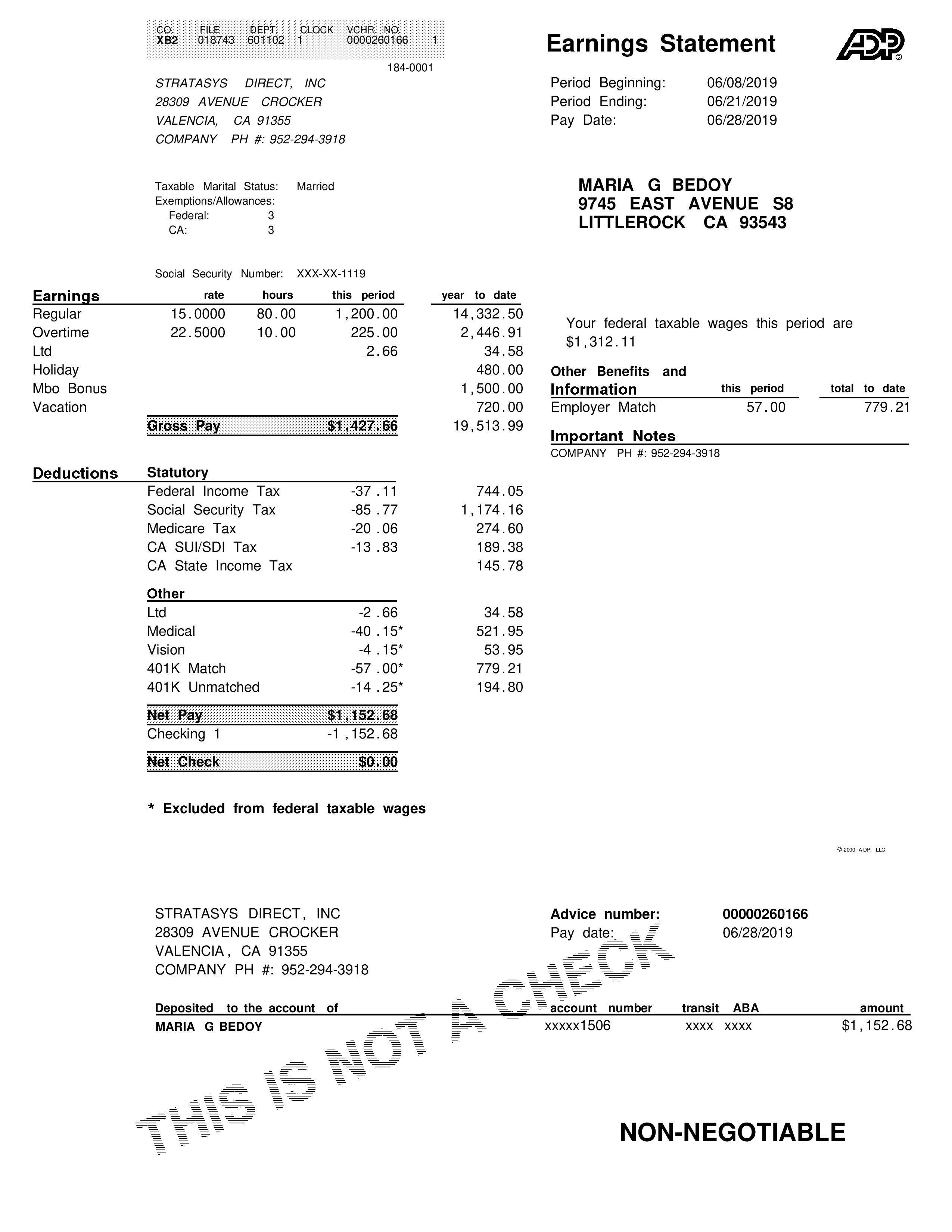

ADP Paystub template

ADP Paystub editable template. Edit the template with all the important information. Save to your computer or print for your records.

A paystub, also known as a paycheck stub or payslip, is a document that provides detailed information about an employee's pay for a particular pay period. Employers typically issue paystubs along with paychecks or direct deposits to their employees.

The information included on a paystub may vary depending on the employer and the country or state in which the employee works, but typically includes:

- Employee's name and address

- Employer's name and address

- Pay period start and end dates

- Gross pay (the total amount earned before any deductions)

- Net pay (the amount received after deductions)

- Federal, state, and local taxes withheld

- Social Security and Medicare contributions

- Retirement plan contributions

- Health insurance premiums

- Other deductions, such as wage garnishments or child support payments

- Year-to-date totals for each category

Why you might need to provide a paystub?

Applying for a loan or mortgage: Lenders may ask for paystubs to verify your income and employment history.

Renting an apartment: Landlords may require paystubs as proof of income to ensure that you can afford the rent.

Applying for government benefits: Some government programs require proof of income to determine eligibility.

Filing taxes: You may need your paystubs to help calculate your taxes or to provide proof of income for tax purposes.

Verifying employment: Some employers may ask for paystubs as part of the verification process for employment or salary history.