ADP W2 2019 Template

2019 ADP W2 Template: A Simple Guide to Your Wage and Tax Statement

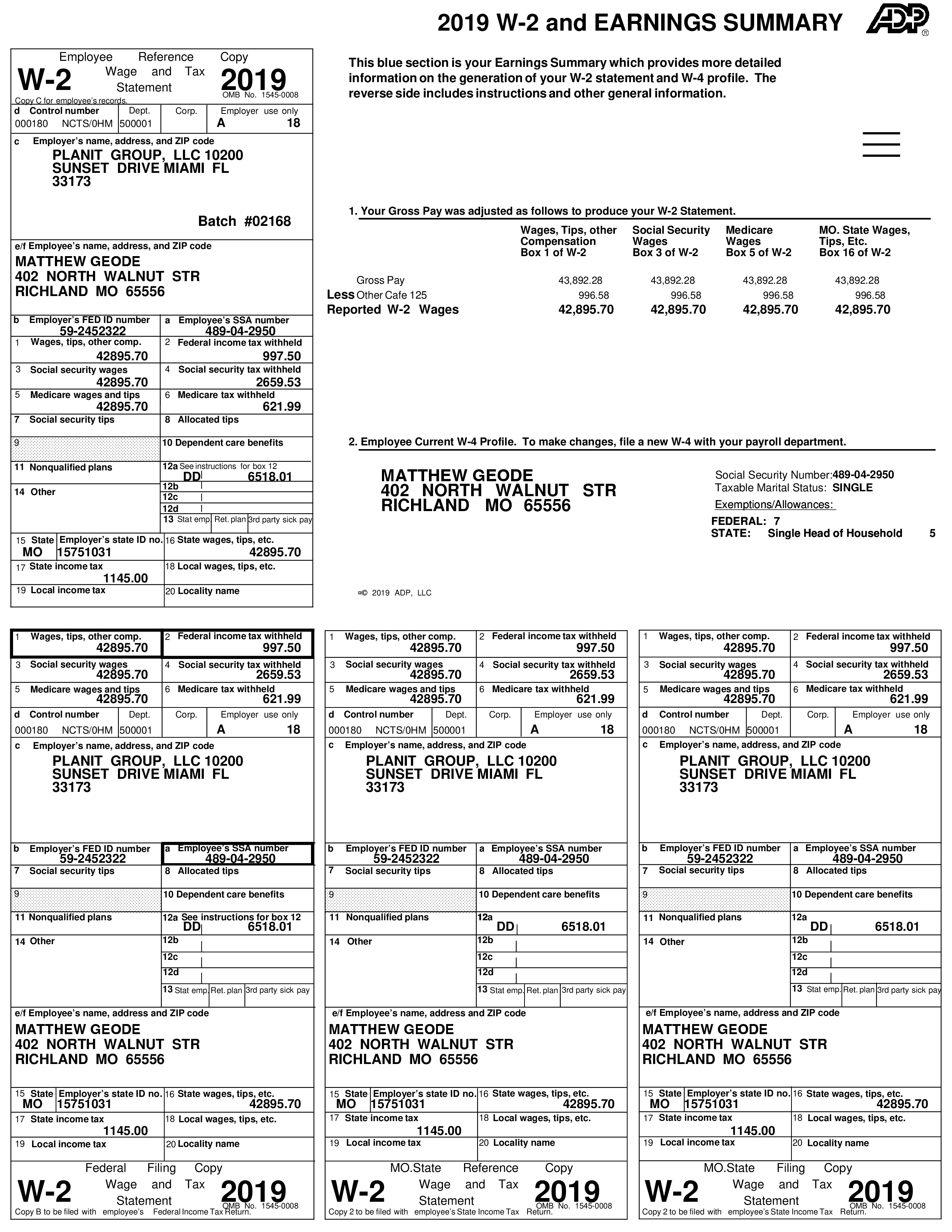

A W2 form, also known as the W-2 Wage and Tax Statement, is like a report card for your income and taxes in the United States. It shows how much money you made during the year and the taxes taken out of your paychecks.

Employers need to give their employees their W2 forms by January 31st every year. These forms help people file their taxes with the federal and state governments. The IRS even has a special page all about the W2 form: About Form W-2, Wage and Tax Statement.

The 2019 W2 template has different sections for important info, such as:

1. Employer details: This is where you'll find your employer's name, address, and employer identification number (EIN).

2. Employee details: Here, you'll see your name, address, and Social Security number.

3. Money stuff: This section shows how much money you earned during the year, including wages, tips, bonuses, and other kinds of pay.

4. Taxes taken out: This part lists how much money was taken out of your paychecks for federal, state, and local income taxes, Social Security tax, and Medicare tax.

5. Benefits: This area covers any money you put aside for things like health insurance, retirement plans, and flexible spending accounts before taxes were taken out.

6. Other info: This section might have extra details about money taken out for things like state disability or unemployment insurance, and other benefits you received.

The W2 form is super important for both employees and employers because it helps make sure everyone pays the right amount of taxes.

Now, let's talk about ADP. It stands for Automatic Data Processing, Inc., and it's a big company that helps businesses of all sizes handle their payroll, benefits, and other employee-related tasks. Lots of employers use ADP's services to manage their payroll and employee information.

When an employer uses ADP to handle payroll, ADP creates and gives out W2 forms for the employer. So, if you see ADP's name on your W2 form, it just means your employer used ADP's services to manage your payroll and make your W2 form. It doesn't change your taxes or your relationship with your employer – it just shows who helped with the paperwork.