ADP W2 2020 Template

2020 ADP W2 template. Editable Wage and Tax Statement template.

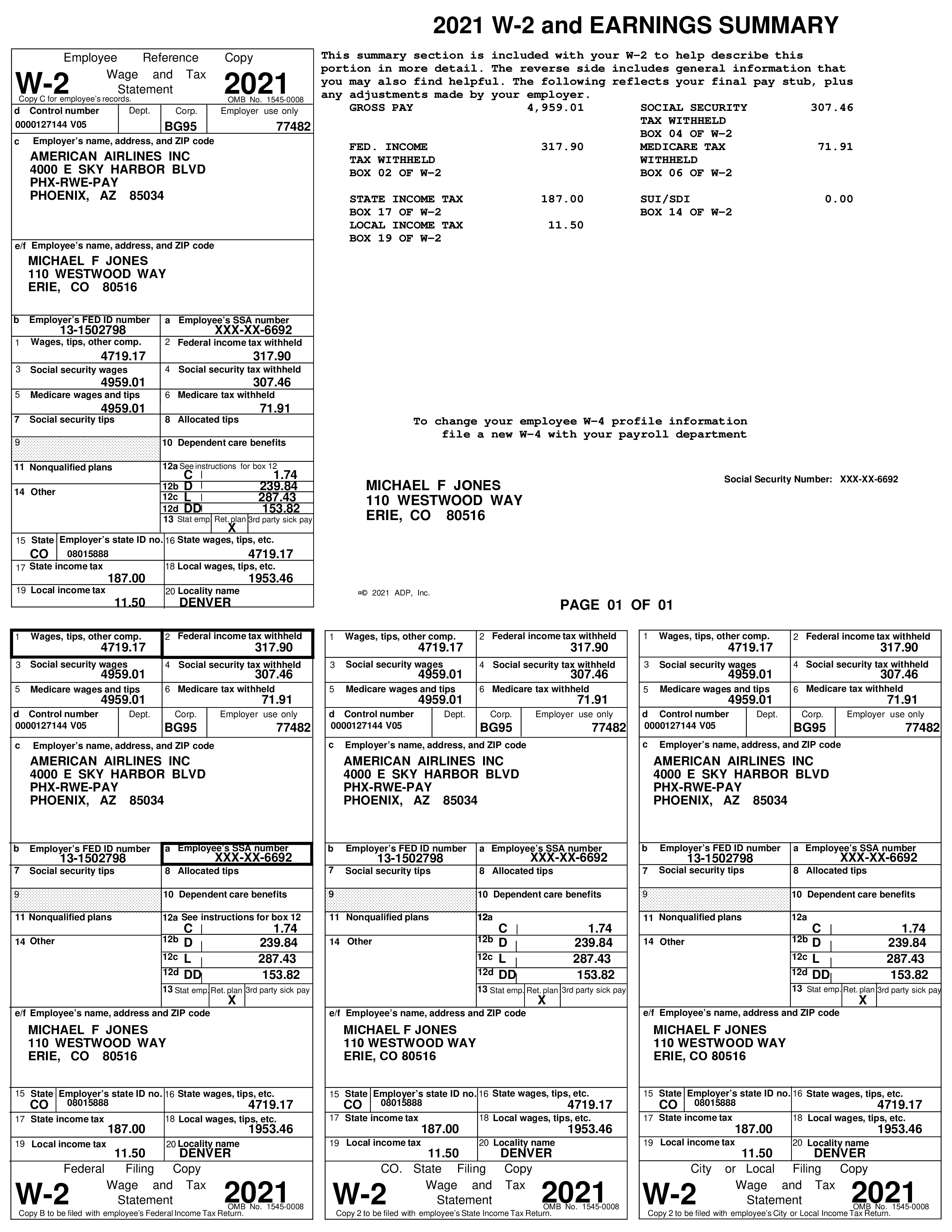

A W2 document, also known as a W-2 Wage and Tax Statement, is a tax form used in the United States to report an employee's income and tax withholdings for the year.

Employers are required to issue W2 forms to their employees by January 31st of each year, and the employees use this form to file their federal and state income tax returns. The IRS has a page dedicated to the W2 information page: About Form W-2, Wage and Tax Statement

This editable W2 template form contains several fields of information, including:

- Employer information: This includes the employer's name, address, and employer identification number (EIN).

- Employee information: This includes the employee's name, address, and Social Security number.

- Wage and salary information: This includes the total amount of wages and salary earned by the employee during the year, as well as any tips, bonuses, and other compensation.

- Tax withholdings: This includes the amounts of federal, state, and local income tax, Social Security tax, and Medicare tax withheld from the employee's paycheck throughout the year.

- Benefits information: This includes any pre-tax deductions the employee made for benefits such as health insurance, retirement plans, and flexible spending accounts.

- Other information: This can include additional amounts withheld, such as for state disability or unemployment insurance, as well as any other compensation or benefits provided to the employee.

Overall, the W2 document is an important form for both employees and employers as it ensures that proper taxes are paid and reported to the government.

ADP stands for Automatic Data Processing, Inc. and it is a global provider of cloud-based Human Capital Management (HCM) solutions that help businesses of all sizes manage their payroll, benefits, time and attendance, human resources, and other related tasks.

Many employers use ADP's services to manage their payroll and employee data. When an employer uses ADP's services for payroll processing, ADP creates and issues W2 forms on behalf of the employer to report employees' earnings and taxes withheld to the federal and state government.

So, if you see ADP's name on your W2 form, it means that your employer has used ADP's payroll processing services to manage your payroll and generate your W2 form. ADP's name on your W2 form does not affect your taxes or your relationship with your employer, but it simply indicates the third-party service provider that your employer used to process your payroll and issue your W2 form.