Bank of America statement template 2021

Edit Now

Bank of America is a multinational financial services company that provides a wide range of banking and financial products and services, including checking accounts, savings accounts, credit cards, loans, and investment services. The company is one of the largest banks in the United States and serves millions of customers worldwide.

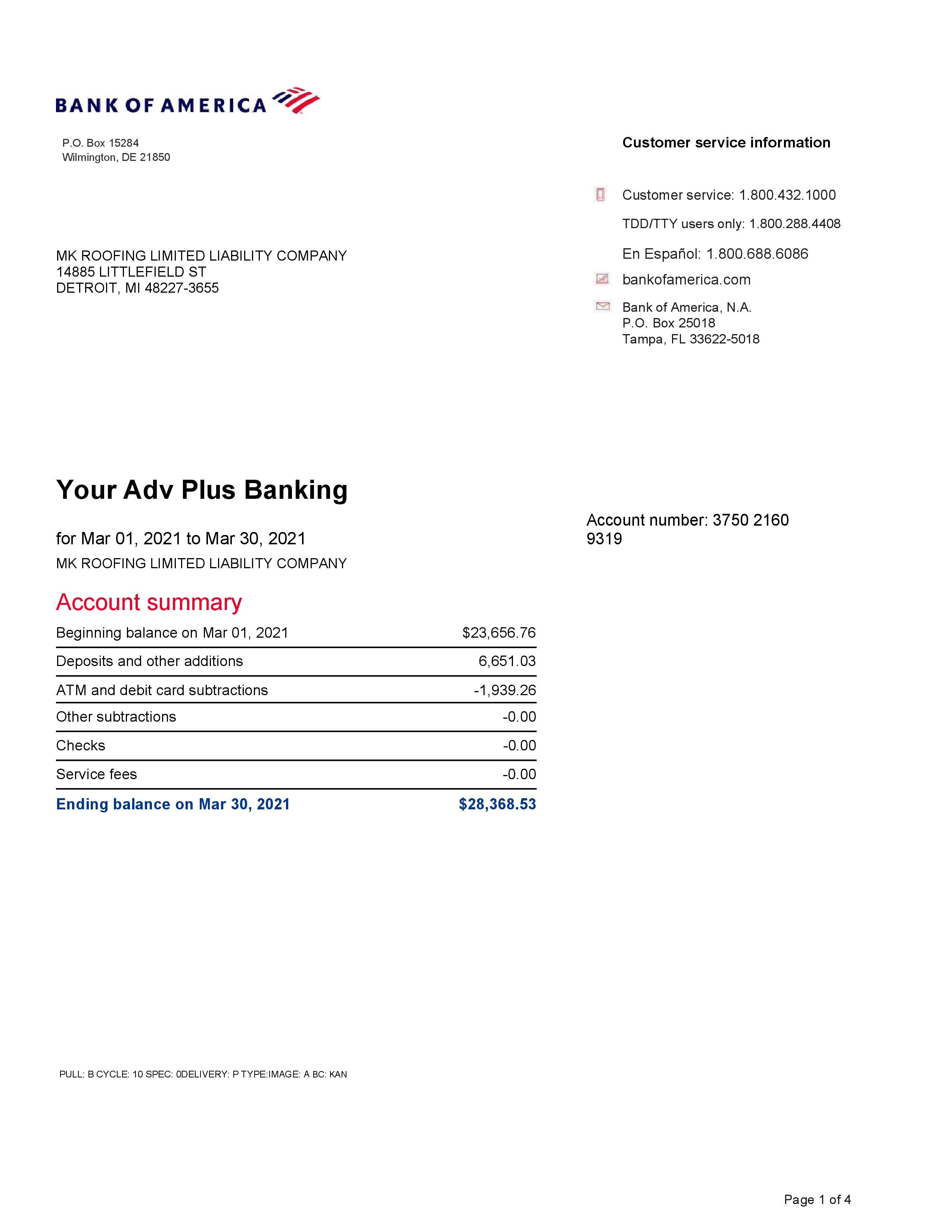

A bank checking statement, also known as a bank statement or account statement, is a document that provides a summary of transactions on a checking account over a certain period of time. Some common items shown on a bank checking statement include:

- Beginning and ending balance: The statement will typically show the balance in the account at the beginning of the statement period and the ending balance after all transactions have been processed.

- Deposits: Any deposits made into the account during the statement period will be listed, including the date, source, and amount.

- Withdrawals: Any withdrawals or payments made from the account will be listed, including the date, payee, and amount.

- Fees and charges: Any fees or charges assessed by the bank during the statement period, such as monthly maintenance fees, overdraft fees, or ATM fees, will be listed.

- Interest earned: If the account earns interest, the statement will show the amount earned during the statement period.

Why you might need to provide a banking statement?

You might need to provide a monthly banking statement for various reasons, such as:

- Auditing purposes: If you or your business is subject to an audit, you may need to provide banking statements to show the flow of funds in and out of your account.

- Tax purposes: You may need to provide banking statements as part of your tax filings or to verify certain deductions or expenses.

- Loan applications: Lenders may ask for banking statements to verify your income and expenses as part of the loan application process.

- Dispute resolution: If you have a dispute with a merchant or vendor, you may need to provide banking statements to show the details of the transaction and any related fees or charges.

- Budgeting and financial planning: You may want to review your banking statements regularly to help you track your spending and identify areas where you can save money.