Hotel invoice template 002

Edit Now

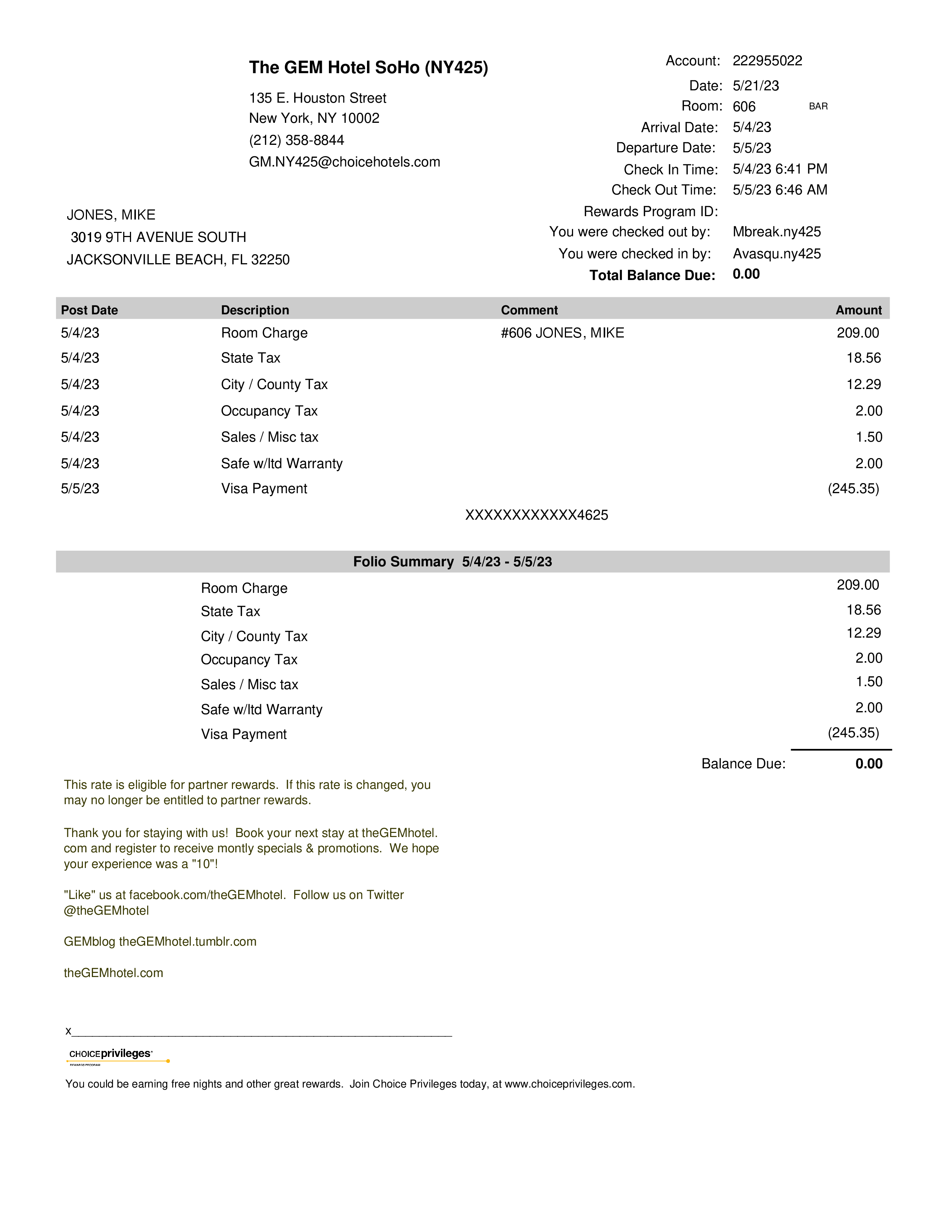

Editable PDF template of hotel invoice for 1 night hotel stay in New York City.

Typical items on a hotel invoice include:

- Room rate: The amount charged per night for the hotel room.

- Taxes and fees: This can include state or city taxes, occupancy taxes, resort fees, and any other fees charged by the hotel.

- Additional charges: This can include charges for room service, minibar items, phone calls, parking, and other amenities or services provided by the hotel.

- Discounts or promotions: Any discounts or promotions that were applied to the stay.

- Payment information: The payment method used and the total amount paid for the stay.

- Dates of stay: The dates that the guest stayed at the hotel.

- Room type: The type of room the guest stayed in, such as a standard room, suite, or premium room.

Some of the reasons why someone might need a hotel invoice include:

Expense reimbursement: If someone is traveling for work, they may need an invoice to submit to their employer for reimbursement of the hotel costs.

Tax purposes: If the hotel stay is tax-deductible, the guest may need an invoice to provide to their accountant or tax preparer.

Dispute resolution: If there is a dispute over the charges or payment for the hotel stay, an invoice can help clarify the charges and resolve any issues.

Personal record-keeping: Some people may want an invoice for their own personal record-keeping or budgeting purposes.