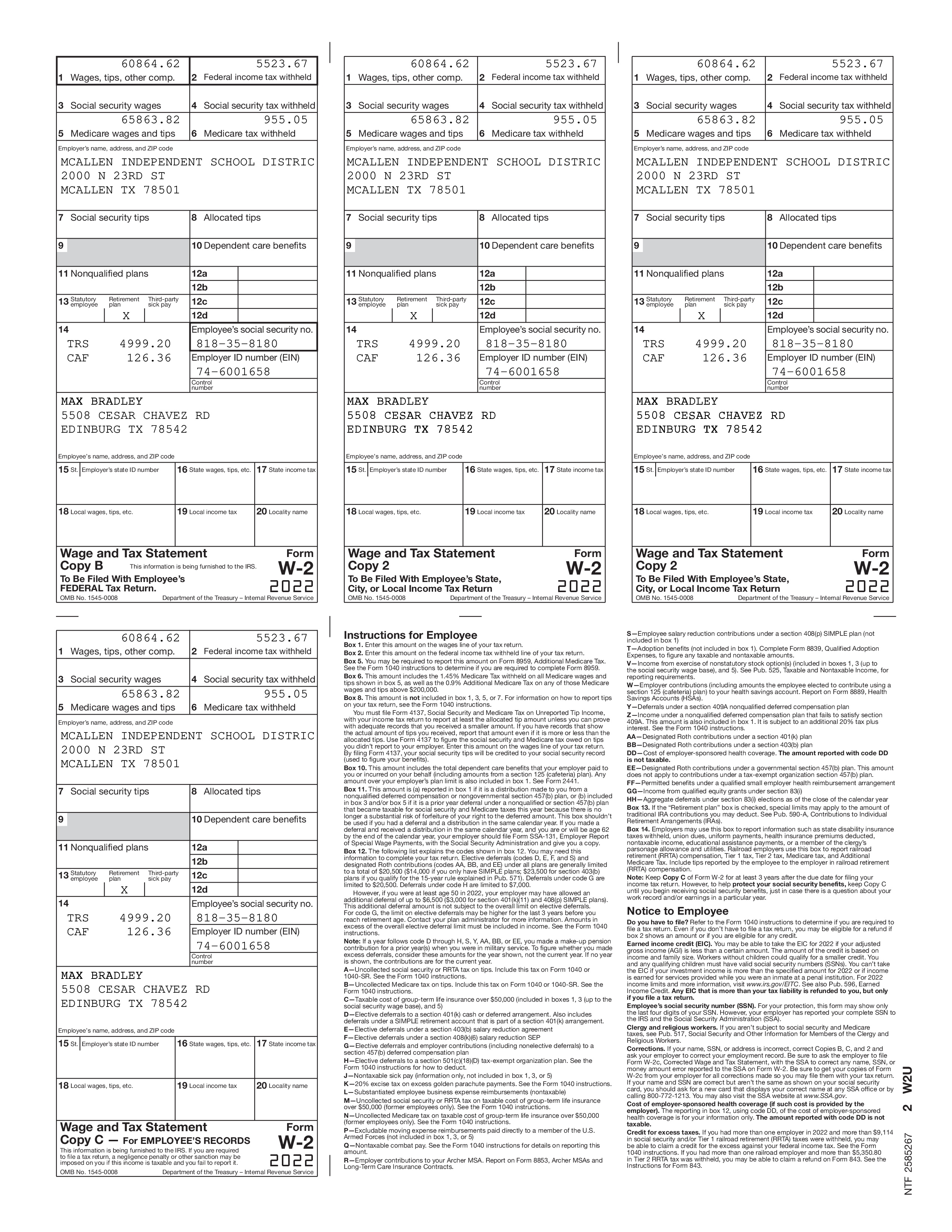

2022 W2 wages income statement

This is a generic W2 template that is editable and high resolution.

A W2 form is a tax document that your employer is required to provide to you every year. Here are some of the reasons why you may need a W2 form:

To file your federal and state income tax returns: Your W2 form contains important information about your earnings, taxes withheld, and other benefits you received from your employer during the tax year. You will need this information to accurately report your income and taxes when you file your tax returns.

To apply for loans or credit: Lenders may require your W2 form as proof of income when you apply for loans or credit.

To verify your employment and income: If you are applying for a job, renting an apartment, or applying for a mortgage, you may need to provide your W2 form to verify your employment and income.

When you receive your W2 form, you should verify that the information on the form is accurate. Here are some things you should check:

Your personal information: Make sure your name, address, and Social Security number are correct.

Your earnings: Check that the wages reported on your W2 form match your pay stubs or other records.

Your taxes withheld: Verify that the federal income tax, Social Security tax, and Medicare tax withheld from your paychecks match the amounts reported on your W2 form.

Your benefits: Check that any benefits you received from your employer, such as health insurance or retirement plan contributions, are accurately reported on your W2 form.